For Immediate Release: April 28, 2014

Press Release by:

Councilmember Mike White, Chair

White proposes taxpayer relief and economic growth in fiscal year 2015

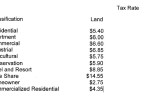

WAILUKU, Hawaii – Budget and Finance Committee Chair Mike White proposed a 9-percent reduction, on average, in real property tax rates for the fiscal year 2015 budget, his office announced today.

The proposal stands in contrast to the mayor’s budget proposal, which increases real property tax rates by an average of 6.5 percent and county spending by $63 million. White’s proposal cuts the mayor’s proposed $623 million budget to $594 million.

Figures presented by White showed Maui County’s economic recovery lagging behind Oahu’s and the state’s. Meanwhile, county expenditures and real property tax revenues have increased from 2004 to 2013 by 71 percent and 82 percent, respectively.

Noting real property tax valuations had risen, White said the same revenue-neutrality approach relied upon for the last few fiscal years means it is time for tax rates to be lowered, rather than raised. “Taxpayer relief means leaving more money in the pockets of residents and businesses,” said White.

White noted new collective bargaining agreements will require an estimated $100 million in additional payments from FY 2014 to FY 2017 to pay for mandatory obligations. Increasing the employment base will have a multiplier effect on this obligation. To counter the trend, White said his proposal eliminates expansion positions and exercises the restraint needed to “right-size” government.

White added that the county’s main economic engine, the visitor industry, is still significantly depressed. “From 2007, Maui County’s visitor arrivals are down 4.6 percent and collected revenues are still down 4 percent. We need to avoid imposing unnecessary financial burdens on the community.”

“My goal has consistently been to work within the county’s means. The mayor’s proposed 11 percent increase over the fiscal year 2014 budget is simply not sustainable,” said White.

White proposes a $10 million appropriation to improve county water transmission lines for those in need of water meters, and reductions in agricultural water rates and residential refuse collection fees. White’s proposal also appropriates funding for new business and job creation.

White noted the counties had united in efforts to increase their share of the transient accommodations tax from the state. Last Friday, those efforts apparently earned Maui County another $2.28 million, based on a Conference Committee vote at the Legislature.

“The outcome was a fraction of the sum the counties have rightfully earned,” said White.

“But the council is fiscally prudent and heads into this week of decision making with the task of making do with less. I look forward to collaborating with colleagues to ensure a sustainable future for the county.”

The committee expects to begin voting on the budget later today with a goal of finishing its work Friday. Fiscal Year 2015 begins July 1, 2014.

White’s presentation is available online at www.mauicounty.gov/2015budget.

# # #