CHAIR’S 3 MINUTES

Published in the Maui News, August 5, 2018

By: Councilmember Riki Hokama

On the general election ballot in November, the following question will be posed to voters: “Shall the legislature be authorized to establish, as provided by law, a surcharge on investment real property to be used to support public education?”

The ballot question was authorized by the passage of SB 2922 in the 2018 state legislative session. While the question may seem simple given the importance of supporting the education of our keiki, the amendment fails to address the big-picture challenges faced by the state and the Department of Education.

Undoubtedly, it is vital to ensure our future generations receive a quality education and opportunities for success. However, we must also ensure well-informed and fiscally responsible decisions are made to support an economic environment in which these future generations can thrive.

With this in mind, an audit of the Department of Education is needed prior to tapping into county real property tax revenues. Audits of public departments are common practice and offer a necessary checkup on financial performance and the implementation of programs.

Given that the department has an annual budget of nearly $2 billion, an audit would hold the DOE accountable and ensure public dollars are being appropriately and effectively allocated.

The operations of vital departments such as the DOE are extremely complex. Simply allocating more money for complicated problems will not offer long-term solutions or better outcomes for teachers and students.

Furthermore, allowing the state to collect any real property tax for the purposes of state-level operations is both unprecedented and unwarranted. The 1978 Hawaii State Constitutional Convention granted the counties the power to exclusively administer real property tax to allow for autonomy and accountability. If autonomy is taken away from the counties through state-controlled surcharges, another Constitutional Convention will absolutely be warranted.

This November, voters will be given the opportunity to vote on a measure whether to convene a Constitutional Convention to explore changes in governance.

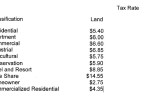

Unanswered questions relating to specifics of the constitutional amendment are also cause for concern. First, the proposed amendment does not clearly define “investment real property.” Arguably, any real property is an investment, including primary residences for families. Overall, the limits and applicability of the surcharge are vague and potentially far-reaching.

Another reason for pause is that the constitutional amendment says the surcharge is to be used to support public education, but doesn’t specify that the revenues raised through the surcharge be used solely for this purpose. In tough economic times, this could open the door for the legislature to raise additional funds from the counties for any state purpose that legislators see fit, without limitation.

Overall, voters must consider the far-reaching implications of the constitutional amendment, which masks the true problems at hand. If equipped with effective audit information, state legislators and the DOE could devise Hawaii-specific solutions for providing quality education for keiki statewide, without taking vital resources from the counties.